by John McCarthy Consulting Ltd. | Oct 22, 2021 | Blog, News

What’s the difference in treatment of investment property between FRS 105 and FRS 102?

Too many accountants rely on the computer software to produce the correct result, which can go badly wrong. You can’t beat reading the standards themselves. In this case, the March 2018 version (as amended) of FRS 105 and more particularly Section 12 of FRS 105 which deals with Property, plant and equipment and Investment Property.

Investment property assets are normally carried at revaluation under Irish GAAP i.e. FRS 102, but it’s dangerous to assume that FRS 105 allows the same treatment. For the purposes of this blog, I am ignoring the FRS 102 options for investment property, which allow for cost/fair value models, in certain circumstances. Instead I want to focus on the fact that FRS 105 removes most FRS 102 options.

Where the company owning the property is a ‘micro-entity’ (as defined in the Companies Act, 2014 with turnover €700k, gross assets €350k, and less than 10 employees), it is not allowed apply the alternative accounting rules/fair value accounting rules under FRS 105, because the Companies Act, 2014 does not permit the use of these options.

Therefore, investment property must be carried at cost under FRS 105.12.3 and the knock-on effect of this is that the investment property must also be depreciated under FRS 105.12.15 because that is a requirement of the cost model.

The bottom line is that if you have ‘small’ (as defined in the Companies Act, 2014) company clients who wish to report investment property assets at revaluation or at fair value, then they must adopt FRS 102 Section 1A (as amended) or else the full version of FRS 102 (March 2018) (as amended).

For more blogs please visit this link and for our publications and manuals and services click here.

by John McCarthy Consulting Ltd. | Oct 12, 2020 | Blog, News

Are your engagement letters up to date?

Once upon a time it was possible to have the same client engagement letter in place for several years, without too much upset.

However, the pace of change in the various pieces of overlapping legislation (much of it of a whistleblowing nature) that impact on engagement letters, seems to be getting faster and faster. Different obligations under criminal law, tax law, company law and anti-money laundering that are now required in the typical contract with your client, mean that there is a never ending requirement to review your letters and issue revised and updated letters to your clients on an annual basis.

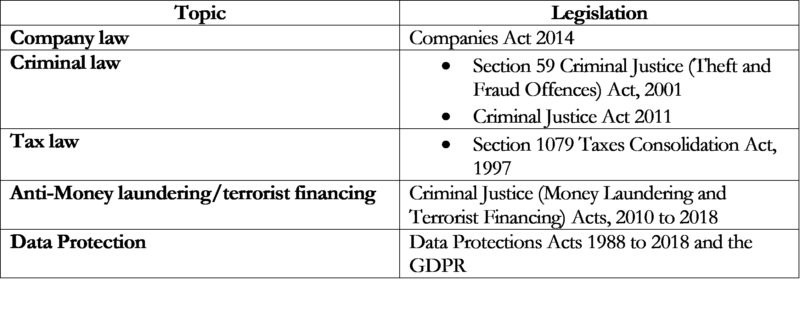

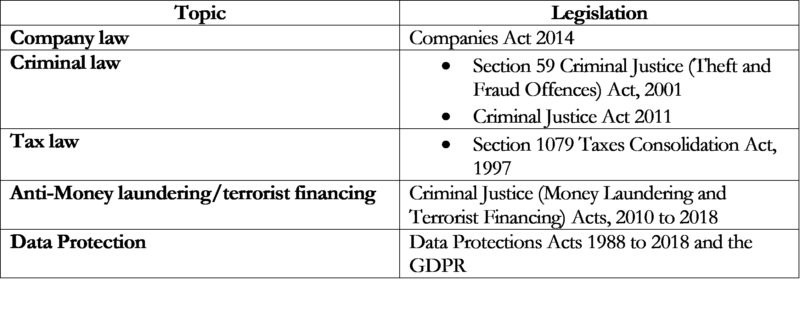

Here is a quick checklist of the legislation you need to include in audit engagement letters:

Audit engagement letter under the Companies Act 2014:

In future issues of this blog, we will cover the typical legislative references required in engagement letters for other entities including specialised ones like solicitor clients (reporting under the Solicitors Accounts Regulations of the Law Society), auctioneers, owners management companies, charities and insurance intermediaries.

by John McCarthy Consulting Ltd. | Jun 29, 2020 | Blog, News

Does your ISQC1 Audit Quality Control Manual deal with:

• Root Cause Analysis(best practice developments following cold file reviews) and

• Section 934 I (3) of the Companies Act, 2014 – as introduced by the Companies (Statutory Audits) Act, 2018 from 21 September 2018, dealing with reporting systems within audit firms to allow audit personnel make reports of relevant contraventions under the Companies Act, 2014?

If not, then take a look at the latest June 2020 edition of our ISQC1 Audit Quality Control Manual for only €150+VAT. Available here for immediate download.

The Manual enables audit firms to comply with the latest audit quality control requirements and has a template to comply with the 2016 edition of the International Education Standard 8 (IES 8) – the standard that addresses the ongoing education (CPD requirements) of Responsible Individual auditors.’

Other up to date template letters of engagement/representation (including many dealing with COVID-19) are available at our online store