by John McCarthy Consulting Ltd. | Nov 16, 2020 | Blog, News

In recent weeks we have written about the issue of carrying out remote stocktakes as well as remote audits. Last week we covered five key matters to consider when carrying out a remote stocktake.

A quite common occurrence will arise where staff don’t feel comfortable attending an inventory audit, given the risk to their health. What are the options if management delays the inventory count for a number of months, hoping that COVID will have abated by then?

Government health guidelines and restrictions take priority over any inventory audit. If Coronavirus (COVID-19) restrictions are in place, it may be necessary to cancel or delay attendance at inventory counts to prioritise staff wellbeing and safeguard staff at the client entity and third parties.

Where management will conduct the inventory count, examine their plans in advance and consider how they are going to conduct the count and whether the measures are likely to be effective.

Will COVID restrictions lessen significantly in the near future? This is far from certain. Conditions could worsen or remain the same. Delaying stock counts may not improve the ability of management or auditors to perform appropriate procedures. This may in the end cause the audit opinion to be a ‘limitation in the scope of the audit’ which may also raise questions about the adequacy or otherwise of the company’s accounting records under the Companies Act, 2014.

Another solution is that management perform a count after the year-end, and the auditors perform a roll-back i.e. perform testing procedures after the year-end and audit the intervening management reconciliation of the inventory counted, with the year-end inventory.

Long time lags can give an opportunity for conditions to improve, but the longer the delay, the less likely it is that a roll-back reconciliation will be sufficiently accurate. The extent of inventory movements will have a big influence on the accuracy of roll-backs. There could be a limit on stock movements because of Covid restrictions, but this depends on the industry.

Another matter to consider is whether inventory can be accessed during the intervening period, i.e. are warehouses and other relevant premises going to remain open?

Plan how stock movements can be reconciled to the accounting system, taking account of:

- the types of inventory and

- the volume of transactions, and

- how stock conditions can be assessed post year-end. This will often depend on the typical life of the inventory.

Stock turnover – this will have an influence on the reconciliation so that a large volume of transactions may make a roll-back difficult e.g. for manufacturers with raw materials, WIP and finished goods, a reconciliation may not be so straightforward.

Onward intrepid auditors!

For more on this topic visit the ICAEW website Coronavirus (COVID-19): Considerations for inventory audit testing.

For a complete list of our time-saving engagement letter templates for audit, non-audit, tax, grant claims, forensic services visit our store here. We have other templates like letters of representation dealing with Brexit and Covid-19.

Want to catch up on your CPD before the end of 2020 see our suite of webinars here.

For the latest technical resources on Covid-19 please visit the

- Chartered Accountants Ireland Covid hub here

- ICAEW Covid-19 hub here

by John McCarthy Consulting Ltd. | Nov 10, 2020 | Blog, News

When the Coronavirus (COVID-19) first broke in Ireland we wrote about the issue of carrying out remote stocktakes as part of remote audits.

While it’s a possibility that the lockdown restrictions may be lifted in early December, there may still be some reluctance among audit personnel and among staff in client entities, meeting in person, thereby making remote stocktaking of prime consideration.

Five things to consider in planning for remote inventory counts are:

- Drones or remotely controlled robots, might help with your inventory testing in some cases, but the cooperation of client personnel and safety restrictions on flying of drones need to be taken into account and will be heavily influenced by the geography and physical surroundings of where the stock is located.

- Control of the drone footage and who is in control of how and where the cameras are directed needs discussed with clients in advance. If the auditor is not in control, then there is a risk that the recorded footage could be manipulated.

- Completeness is one of the main audit assertions and the auditor needs to consider this when planning a remote stocktake. Assess whether the cameras will allow you to see all of the inventory at any one point in time and also consider the risk that certain items could be kept out of view or are moved around behind the camera’s view and might be omitted from the stock count.

- Assessing the condition of the inventory is another critical matter. Video cameras with strong resolution are necessary so that inventory damage can be better assessed. In some cases, photographic images of stock may be more accurate in assessing damaged or obsolete inventory.

- Selecting samples for testing is another critical matter including the consideration of increasing sample sizes for the added risks mentioned here. Selecting items only during the count itself (with no advance notification ) and then identifying the items to be tested from floor to sheet and sheet to floor can help to reduce the risk of manipulation

Given these technology constraints, staff with prior experience of inventory counts will be better able to handle the unexpected, and ideally should be accompanied by other experienced personnel.

For a complete list of our time-saving engagement letter templates for audit, non-audit, tax, grant claims, forensic services and other templates like letters of representation dealing with Brexit and Covid-19, visit our store here.

We also have a suite of 19 webinars if you want to catch up on your CPD before the end of 2020 here.

For the latest technical resources on Covid-19 please visit the

- Chartered Accountants Ireland Covid hub here

- ICAEW Covid-19 hub here

by John McCarthy Consulting Ltd. | Oct 12, 2020 | Blog, News

Are your engagement letters up to date?

Once upon a time it was possible to have the same client engagement letter in place for several years, without too much upset.

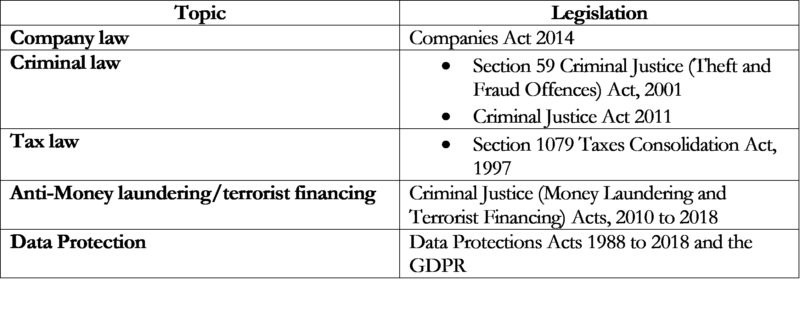

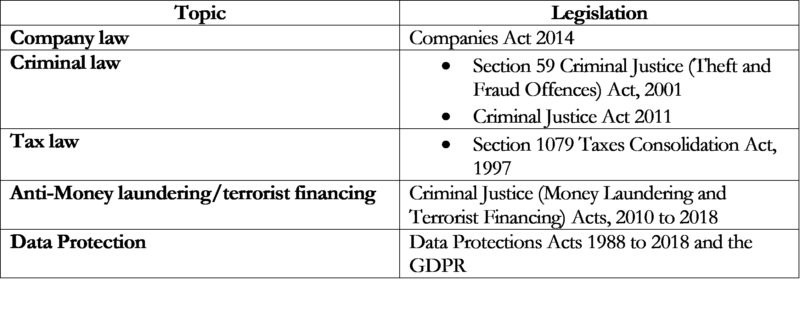

However, the pace of change in the various pieces of overlapping legislation (much of it of a whistleblowing nature) that impact on engagement letters, seems to be getting faster and faster. Different obligations under criminal law, tax law, company law and anti-money laundering that are now required in the typical contract with your client, mean that there is a never ending requirement to review your letters and issue revised and updated letters to your clients on an annual basis.

Here is a quick checklist of the legislation you need to include in audit engagement letters:

Audit engagement letter under the Companies Act 2014:

In future issues of this blog, we will cover the typical legislative references required in engagement letters for other entities including specialised ones like solicitor clients (reporting under the Solicitors Accounts Regulations of the Law Society), auctioneers, owners management companies, charities and insurance intermediaries.

by John McCarthy Consulting Ltd. | Apr 12, 2016 | News

The advent of the new accounting standard FRS 102 for financial periods commencing 1 January 2015 has triggered the need to update engagement letters for both audit and audit exempt companies. Some of the issues that the new engagement letters will need to deal with include:

- the Companies Act, 2014

- allocating responsibility for the decision to apply the ‘undue cost or effort’ exemption for any items in the financial statements and the rationale for so doing;

- financial instruments (including the treatment of long term directors’ and inter-company loans);

- investment properties;

- business combinations including goodwill and the recognition and treatment of intangible assets;

- deferred tax and

- defined benefit pension schemes.

For auditors, the engagement letter will need to clearly spell out what types of advice are permitted and which are not allowed e.g. advice on the implementation of current and proposed accounting standards (e.g. FRS 102) is excluded from the definition of ‘accounting services’ in ES5 ‘Non-audit services provided to audited entities’ [1]. However, auditors will need to take care in providing such services, and guard against giving bookkeeping advice and making specific accounting entries, where these go beyond the technical, mechanical or informative nature.

If you would like complete templates of the different entity engagement letters (and indeed representation letters) they are available at €50 plus VAT each. There is a discount for orders of five or more when the charge is five for the price of four.

Among the types of letter available are

- Standard company audit engagement letter;

- MUD Act company limited by guarantee audit engagement letter;

- MUD Act company limited by guarantee audit representation letter;

- Standard company limited by guarantee audit engagement letter;

- Standard company limited by guarantee audit representation letter;

- Standard company audit representation letter;

- Audit exempt company engagement letter;

- Audit exempt company representation letter.

We can also tailor other letters to order. Please send us an e-mail to john@jmcc.ie with the words ‘engagement letter’ in the subject line.

To hear more about the accounting developments in FRS 102 and for online booking on our upcoming FRS 102 course on Tuesday 19 April in the Camden Court Hotel, Dublin 2, please click the following link FRS 102 – The Journal Entries.

[1} Paragraph 156, ES5 ‘Non-audit services provided to audited entities’ (updated December 2011)