by John McCarthy Consulting Ltd. | Nov 28, 2023 | Blog, News

A controversial proposal to update the UK FRC Revised Ethical Standard from the Financial Reporting Council in the UK states that they are proposing to enhance the prohibition (among other proposals) on certain tax services that can be provided to the majority shareholders of unlisted entities. The proposal is for this service to be banned in the UK from 15 December 2024. Please note that this is a UK proposal only and is not necessarily going to be adopted as currently worded. It does not apply to audits for Republic for Ireland entity audits.

The proposal wording is as follows (quoting from the consultation document):

Tax Services

5.67 The range of activities encompassed by the term ‘tax services’ is wide. They include where the firm:

(a) provides advice to the entity on one or more specific matters at the request of the entity; or

(b) undertakes a substantial proportion of the tax planning or compliance work for the entity; or

(c) promotes tax structures or products to the entity, the effectiveness of which is likely to be influenced by the manner in which they are accounted for in the financial statements, or in audit subject matter information;

(d) performs any of the services described in paragraphs a-c to individuals who are the majority owner(s) of an unlisted entity relevant to an engagement.

This latter service is proposed to be banned from 15/12/2024 in the UK.’ The consultation is now closed as the deadline was 31 October 2023.

The reason we bring this to the attention of our readers in Ireland is that quite often the Irish Audit & Accounting Supervisory Authority (the audit regulator in Ireland) has, in the past, incorporated similar changes to the Code of Ethics for Auditors in Ireland, sometimes with amendments, but not always.

The normal process would be for the Irish Audit & Accounting Supervisory Authority to consult in Ireland on any changes to its Code of Ethics and, taking account of feedback received, may then publish a new Ethical Standard for auditors, which would most likely not be effective before 15 December 2024. At the time of writing we have no notice of such intent on the part of the Irish Audit & Accounting Supervisory Authority.

IT Controls Assessment

Auditors are reminded that there are relatively significant changes in the requirements of ISA 315 Identifying and Assessing the Risks of Material Misstatement for accounting periods commencing 15 December 2021, which in practical terms means, accounting periods Ended 21 December 2022 and later.

Auditors dealing with the audits of entities with such accounting periods affected by these change will need, to adopt new audit programmes and, in additional to the normal audit tests, to also assess the entity’s IT controls (no matter what the size of that entity).

This is a significant new development for auditors of SMEs, in particular, and will be a game changer ion the type of audit documentation and evidence of assessment of such IT controls by the auditor on audit files.

For an easy to implement additional (two page) IT Controls Questionnaire to help document the above process, please click on this link to download immediately for only €60 + VAT.

Please also go to our website to see our:

- Anti-Money Laundering Policies Controls & Procedures Manual (March 2022) – View the Table of Contents click here.

- AML webinar (March 2022) available here, which accompanies the AML Manual. It explains the current legal AML reporting position for accountancy firms and includes a quiz. Upon completion, you receive a CPD Certificate of attendance in your inbox.

- letters of engagement and similar templates. Please visit our site here where immediate downloads are available in Word format. A bulk discount is available for orders of five or more items if bought together.

- ISQM TOOLKIT or if you prefer to chat through the different audit risks and potential appropriate responses presented by this new standard, please contact John McCarthy FCA by e-mail at john@jmcc.ie.

We typically tailor ISQM training and brainstorming sessions to suit your firm’s unique requirements. The ISQM TOOLKIT 2022 is available to purchase here.

by John McCarthy Consulting Ltd. | Jun 23, 2020 | News

‘Going concern’ is not a simple binary or pass/fail concept. A company can be a going concern even when one or more material uncertainties exist. In such circumstances what becomes important is the disclosure about the uncertainties and management’s consideration of these.’ Quote from the recent Financial Reporting Lab’s guidance on ‘Going concern, risk and viability’ in the midst of the Coronavirus (COVID-19).

The Financial Reporting Lab of the Financial Reporting Council last week published two documents that give clear incisive guidance, with real life examples, dealing with:

The three key areas that need attention and disclosure relating to going concern are:

- Is the company a going concern?

- Has the assessment considered factors relevant to COVID-19?

- Is the disclosure sufficiently detailed?

Covid-19 disclosures

If you are wondering what Coronavirus (COVID-19) disclosures companies should be making in their financial statements, we have the answer. Our recently published survey of 22 public company financial statements focuses on their Coronavirus (COVID-19) disclosures.

Among the disclosures addressed in our report are topics such as:

- Emphasis of Matter

- Key Audit Matters in Audit Reports

- Going Concern/Viability

- Post Balance Sheet Events/Subsequent Events

This thirty-page report, is available on our website, and includes more detail of the types of disclosures that are prevalent at the moment and elaborates on the topics below. All this research is available to purchase for just €125+VAT, for immediate download.

For more on the Coronavirus (COVID-19) disclosures, please see our published report on our website here.

In our Publications Store, you will also find many complementary letters of representation templates that deal with the Coronavirus (COVID-19).

by John McCarthy Consulting Ltd. | Jun 15, 2020 | Blog

In May 2020, the EU Commission predicted that Irish GDP will contract by 7.9% in 2020, as a result of the Coronavirus (COVID-19). The good news is that it has predicted a bounce back of 6.1% in 2021.

In this climate, the provision of accurate financial information will be critical in getting Ireland back to health. Where can we find good, up to the minute guidance on this topic?

The hidden jewel in the crown of the Financial Reporting Council, the Financial Reporting Lab, has, once again, justified this title. On 15 June 2020, the Lab published two documents that give clear incisive guidance, with real life examples, dealing with:

- ‘Resources, actions and the future’ – practical advice to companies setting out the disclosures investors expect to see from companies during this time of uncertainty

- ‘Going concern, risk and viability’ – which gives guidance on going concern, risk and viability disclosures.

This week we focus on the Resources, actions and the future document that helps Directors and others with how to address three key topics in their annual reports:

- Resources – including the availability of cash.

- Actions – to manage short-term expenditure and ensure viability.

- The future – how the decisions taken now ensure the sustainability of the company and impact customers, suppliers and employees.

Covid-19 disclosures

If you would like to more examples of recent Coronavirus (COVID-19) disclosures in financial statements, see our recently published survey of 22 public company financial statements which highlight Coronavirus (COVID-19) disclosures.

The types of disclosures addressed in our report include topics such as:

- Emphasis of Matter

- Key Audit Matters in Audit Reports

- Going Concern/Viability

- Post Balance Sheet Events/Subsequent Events

This thirty-page report, is available on our website, and includes extracts from the types of disclosures that are prevalent at the moment. All this research, saving you time, is available to purchase for just €125+VAT, for immediate download.

For more on the Coronavirus (COVID-19) disclosures, please see our published report on our website here.

In our Publications Store, you will also find many complementary letters of representation templates that deal with the Coronavirus (COVID-19).

by John McCarthy Consulting Ltd. | Jun 8, 2020 | News

The Financial Conduct Authority in the UK said in March 2020 that all London listed companies are permitted two extra months to publish their audited financial results, giving them six months in total.

Meanwhile the Irish Companies Registration Office has further extended the filing deadline for all annual returns that are normally due for filing in the coming months. These will be deemed to have been filed on time if all elements of the annual return are completed and filed by 31st October 2020.

The filing arrangements for Industrial & Provident Societies, Friendly Societies and Trade Unions for filing with the Registry of Friendly Societies are extended to 31st December 2020.

Covid-19 disclosures.

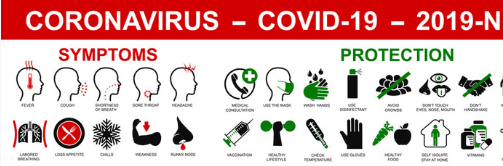

Are you wondering what Coronavirus (COVID-19) disclosures companies should be making in the financial statements to achieve a true and fair view?

We have the answer. Our recently published survey of 22 public company financial statements focuses on their Coronavirus (COVID-19) disclosures.

Of the companies that included Coronavirus (COVID-19) somewhere in their annual reports, Coronavirus (COVID-19) was included in the audit reports of all four companies that had January year ends.

Other disclosures addressed in our report include topics such as:

• Emphasis of Matter

• Key Audit Matters in Audit Reports

• Going Concern/Viability

• Post Balance Sheet Events/Subsequent Events

This thirty-page report, is available on our website, and includes more detail of the types of disclosures that are prevalent at the moment and elaborates on the topics below. All this research is available to purchase for just €125+VAT, for immediate download.

For more on the Coronavirus (COVID-19) disclosures, please see our published report on our website here.

In our Publications Store, you will also find many complementary letters of representation

templates that deal with the Coronavirus (COVID-19).

by John McCarthy Consulting Ltd. | Jun 2, 2020 | Blog

We have recently published a survey of 22 public company financial statements focusing on their Coronavirus (COVID-19) disclosures.

Of those companies surveyed, the John Lewis Partnership plc had some of the greatest level of going concern discussion in the notes to the financial statements, with a prominent note under the ‘Basis of Preparation’ section on page 95.

Our thirty-page report, is available on our website, and includes more detail of the types of disclosures that are prevalent at the moment and elaborates on the topics below. All this research is available to purchase for just €125+VAT, for immediate download.

The various disclosures in the report cover topics such as:

• Emphasis of Matter

• Key Audit Matters in Audit Reports

• Going Concern/Viability

• Post Balance Sheet Events/Subsequent Events

For more on the Coronavirus (COVID-19) disclosures, please see our published report on our website here.

In our Publications Store, you will find many complementary products that deal with the Coronavirus (COVID-19), especially letters of representation that seek written representations from the management of relevant entities about their preparedness for the future impact of the virus on their organisations.