by John McCarthy Consulting Ltd. | Nov 3, 2020 | Blog, News

Come 31 December 2020, many external auditors will be planning for the audit busy season and the issue of remote stocktakes (more on this in a future blog) and carrying out remote audits.

31 December is the most common company year end in Ireland. Because the pandemic struck after 31 December 2019, the Coronavirus (Covid-19) was deemed, in most cases, to be a non-adjusting post balance sheet event. For 31 December 2020 period ends, auditors no longer have that luxury and will need to take even greater care with events taking place in their audit clients since the advent of the Coronavirus (Covid-19) in March 2020.

One UK firm I have come across is having partner consultations on every audit report they issue. Obviously, this approach may not be appropriate for all audits, as some client sectors are more affected by Covid-19 than others. It is very important that attention be give to the following key items:

- Transparent and logical documentation of any revised audit approach;

- Direct lines of communication within the firm and

- Written evidence of compliance.

Many of the issues faced by the management and staff of client entities are also faced by auditors. In both cases, where we come in and out of lockdown, there is a need to manage younger staff, staff with small children/dependents and staff working in less than ideal home environments. Auditors will need to include in their 2020 audit plans the potential risk and/or impact of secondary outbreaks that may lead to the reintroduction of restrictions in early 2021.

Five matters that are critical to consider:

- Consider accuracy, completeness, relevance, and reliability. These are the four critical audit evidence components. You have to use your judgment as to what is reliable, relevant evidence that you can use in an electronic environment.

- Beware of the potential for cyberattacks. There seems to be increased risk related to hackers trying to take advantage of Covid-19 using various scams related to the Pandemic.

- Use laptop cameras effectively for client and team meetings. Video discussions and interviews with clients are going to be essential in the remote audit process.

- Flexible schedules. Clients as well as audit team members will welcome this. Flexibility is called for here so everyone is willing to adjust timetables to make it convenient and more accessible for clients. Some people may work better from 7 a.m. to 9 a.m. Or 6 p.m. to 8 p.m., depending on daily routines.

- Be prepared for change. Post Covid-19 business will be done differently. By now technology has taught us that there are more ways of getting things done, than we had allowed, prior to Covid. Firms will need to plan for the short, medium, and long-term as to how remote working is going to impact.

For a complete list of our time-saving engagement letter templates for audit, non-audit, tax, grant claims, forensic services and other templates like letters of representation dealing with Brexit and Covid-19, visit our store here.

We also have a suite of 19 webinars if you want to catch up on your CPD before the end of 2020 here.

For the latest technical resources on Covid-19 please visit the

- Chartered Accountants Ireland Covid hub here

- ICAEW Covid-19 hub here

by John McCarthy Consulting Ltd. | Oct 20, 2020 | Blog, News

Our blog two weeks ago highlighted the main pieces of legislation that go into an audit letter of engagement, while last week we looked at the fundamentals of tax engagement letters.

This week we show you a checklist that covers worthwhile clauses for all types of letters of engagement:

- Exclusion clause. Because tax services can be broad, an exclusion clause that identifies what services will not be provided can be invaluable. For example, a payroll taxes preparation engagement might exclude subcontractor tax, personal or corporate tax compliance, and Forms P11D preparation.

- Deadline for submitting return information. Establishing a date by which the client must provide the information needed to prepare the return is essential.

- Limitation on use of the returns. Clients may submit tax returns and/or supporting data (like rental income computations) to third parties in lieu of a financial statement, for which potential liability can be addressed through a clause limiting the circulation of tax returns, supporting data and distribution and/or requiring advance written permission before allowing the client circulate the information to named third parties.

- Tax position clauses. Many times, what the client thinks is acceptable will conflict with professional standards. Establish language stating that tax positions taken must satisfy professional standards.

- Supporting documentation. Because a Revenue audit or investigation is always a possibility, remind clients of their responsibility to maintain adequate records to support the deductions claimed on the return. Include in the letter a reminder of the length of time for which the records should be maintained.

- Revenue Audit. Representing a client in a Revenue Audit may be more involved than the tax return preparation itself, for which many accountants may want to deal in a different manner to the main tax assignment e.g. by allowing for the use of specialist advice. The engagement letter should state that in the event of a Revenue Audit the assignment will be covered by the terms of a separately signed engagement letter.

- Outcome or results. The engagement letter is not a marketing device. Never guarantee the outcome or results.

- Limitation of liability. Ensure such clauses are used appropriately.

- Complaints/best service. Make it clear what the lines of communication are in the event of a dispute or claim (give the contact name for the Partner/Director in your organisation that will primarily handle client complaints) and in the event of failure to reach a satisfactory outcome, give the contact details of your professional body.

For a complete list of our time-saving engagement letter templates for audit, non-audit, tax, grant claims, forensic services and other templates like letters of representation dealing with Brexit and Covid-19, visit our store here.

We also have a suite of 19 webinars if you want to catch up on your CPD before the end of 2020 here.

by John McCarthy Consulting Ltd. | Jun 18, 2014 | News

Welcome to another of our regular blogs on topical issues for accountants in practice.

Our last blog https://jmcc.ie/d7/node dealt with engagement letters in general and focused on audit and audit exempt engagement letters. This blog targets tax engagement letters specifically.

Engagement letter fundamentals – an important line of defence

Tightening the language used in tax and other engagement letters will help limit your professional liability.

In recent times we have noticed a renewed interest by accountancy firms in having well written and up to date engagement letters reviewed and critiqued by risk management professionals. The objective of this article is to outline the fundamentals of tax and other types of engagement letters and to suggest provisions that will help minimize legal liability faced by accountants in practice.

Professional liability insurers and solicitors specialising in professional negligence claims will often agree that engagement letters are one of the first lines of defence in a professional negligence claim against an accountant. When drafted properly, engagement letters form the basis for an enforceable contract and should have caveats unique to the scope of the service provided, the amount of risk inherent in the engagement, and the need to satisfy professional standards.

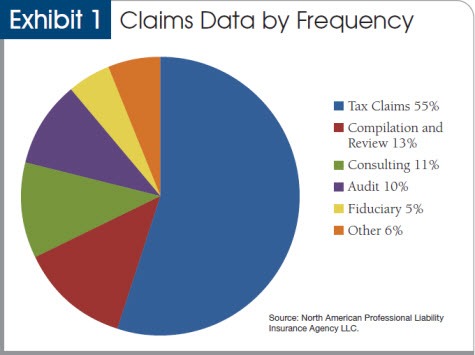

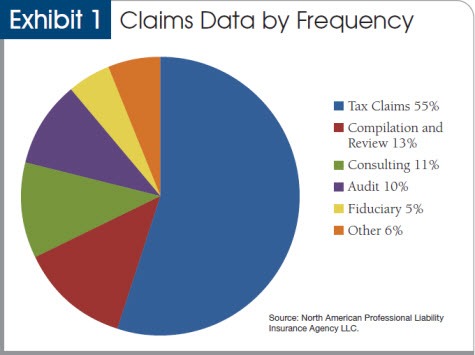

The majority of claims (by frequency) reported by leading professional indemnity insurers arise from tax services, yet, according to our experience, individual tax engagements are where engagement letters are least used. Recent data (January 2014) we have seen from claims arising in the USA show that well over half the claims (by number) arise from tax services.

While the advice that follows is focused on tax engagement letters, the same principles apply to most other types of engagement letter.

Here are some of the fundamental objectives in drafting good engagement letters:

1. Address the letter to the appropriate parties in a formal introductory paragraph. Exclude any taxes not within the scope of the tax return and exclude children of the client or other entities owned by the individual tax client and include the appropriate year or years that are being prepared.

2. Identify which returns are being prepared, and do not combine multiple returns. (For example, do not include a gift tax return service with an income tax return unless the proper disclaimer language for a gift tax return is included.) The following language is highly recommended.

‘We will prepare your [Year] income tax return. This engagement pertains only to the [Year] tax year, and our responsibilities do not include preparation of any other tax returns that may be due to any tax authority, If we receive specific instructions from you about other taxes or other tax years, these assignments will be the subject of separate engagement letters.’

Deal with the price of the service, payment terms, retainers, additional charges for information received late, additional fees. Clarity and diligence must be adhered to, as many professional liability lawsuits, professional body ethical complaints, and loss of clients have resulted from misunderstanding these provisions. Too often, a phrase like the following is used in a standard letter:

‘Our fee for services will be at our standard hourly rate for the personnel assigned to this engagement [or fixed fees to cover other than hourly fee arrangements]. Payment is expected when our services are complete.’’

Consider the following enhancements to the typical clause above:

o Specify more clearly the payment terms.

o If you wish, stipulate that a retainer will be required and will be applied toward the final fee and that the retainer is not an estimate of the fee charged for services.

o Identify when payment is expected.

o Provide for a termination of services if the fee is not paid in full.

o Use an additional charge clause for services not originally contemplated.

o Include a provision for reimbursement for out-of-pocket expenses such as travel, recorded delivery, etc.

3. Use a tax checklist that is sent to clients. The value of a tax checklist in defending a professional liability claim cannot be overstated. However, many tax advisers complain that their clients do not complete the checklist and often return it unopened. Accountants and tax advisers need to get the client to take responsibility for completing the checklist. The language used in the engagement letter should establish this responsibility:

‘We will prepare the returns from information which you will furnish to us. It is your responsibility to provide all the information required for the preparation of complete and accurate returns. We will furnish you with questionnaires and/or worksheets as needed to guide you in gathering the necessary information. Your use of such forms will assist us in keeping our fee to a minimum. To the extent we render any accounting and/or bookkeeping assistance, it will be limited to those tasks we deem necessary for preparation of the returns’.

Each firm has its own comfort level with respect to risk, and every client relationship varies. For this reason, many more areas should be explored for engagement letters than this article can address and this list is not necessarily exhaustive

Engagement Letter Checklist

The following checklist suggests additional considerations for engagement letters, return preparation, and administrative practices:

Exclusion clause. Because tax services can be broad, an exclusion clause that identifies what services will not be provided can be invaluable. For example, a payroll taxes preparation engagement might exclude subcontractor tax, personal or corporate tax compliance, and Forms P11D preparation.

Deadline for submitting return information. Establishing a date by which the client must provide the information needed to prepare the return is essential.

Limitation on use of the returns. Clients may submit tax returns and/or supporting data (like rental income computations) to third parties in lieu of a financial statement, for which potential liability can be addressed through a clause limiting the circulation of tax returns, supporting data and distribution and/or requiring advance written permission before allowing the client circulate the information to named third parties.

Tax position clauses. Many times, what the client thinks is acceptable will conflict with professional standards. Establish language stating that tax positions taken must satisfy professional standards.

Supporting documentation. Because a Revenue audit or investigation is always a possibility, remind clients of their responsibility to maintain adequate records to support the deductions claimed on the return. Include in the letter a reminder of the length of time for which the records should be maintained.

Revenue Audit or HMRC Investigation. Representing a client in a Revenue Audit may be more involved than the tax return preparation itself, for which many accountants may want to deal in a different manner to the main tax assignment e.g. by allowing for the use of specialist advice. The engagement letter should state that in the event of a Revenue Audit/HMRC Investigation the assignment will be covered by the terms of a separately signed engagement letter.

Outcome or results. The engagement letter is not a marketing device. Never guarantee the outcome or results.

Limitation of liability. Ensure such clauses are used appropriately.

Complaints/best service. Make it clear what the lines of communication are in the event of a dispute or claim (give the contact name for the Partner/Director in your organisation that will primarily handle client complaints) and in the event of failure to reach a satisfactory outcome, give the contact details of your professional body.

If interested in having a template engagement letter that follows the above advice, please see our list of engagement letters available for sale below.

Letters of engagement currently available as follows:

1. Limited company audit ROI

2. Limited company – audit exempt ROI

3. Sole trader NI/UK

4. Sole trader ROI

5. Limited by guarantee company ROI

6. MUD Act company – ROI

7. Northern Ireland/UK audit company

8. Northern Ireland/UK – audit exempt company

9. Taxation planning generally

10. Revenue audit Engagement Letter

11. Corporation Tax Engagement Letter

12. Income Tax Engagement Letter

13. Tax disengagement letter (used when a client has ceased using the firm’s tax services, but without a formal notification being received from the client). This letter sets the record straight, to avoid doubt.

These retail at €50 each +VAT, but we are prepared to do discounts for bulk purchases. Once ordered, you will receive a VAT invoice as well as the appropriate engagement letters by e-mail.

Please send us an e-mail to john@jmcc.ie with the words ‘engagement letter’ in the subject line.