by John McCarthy Consulting Ltd. | May 10, 2021 | Blog, News

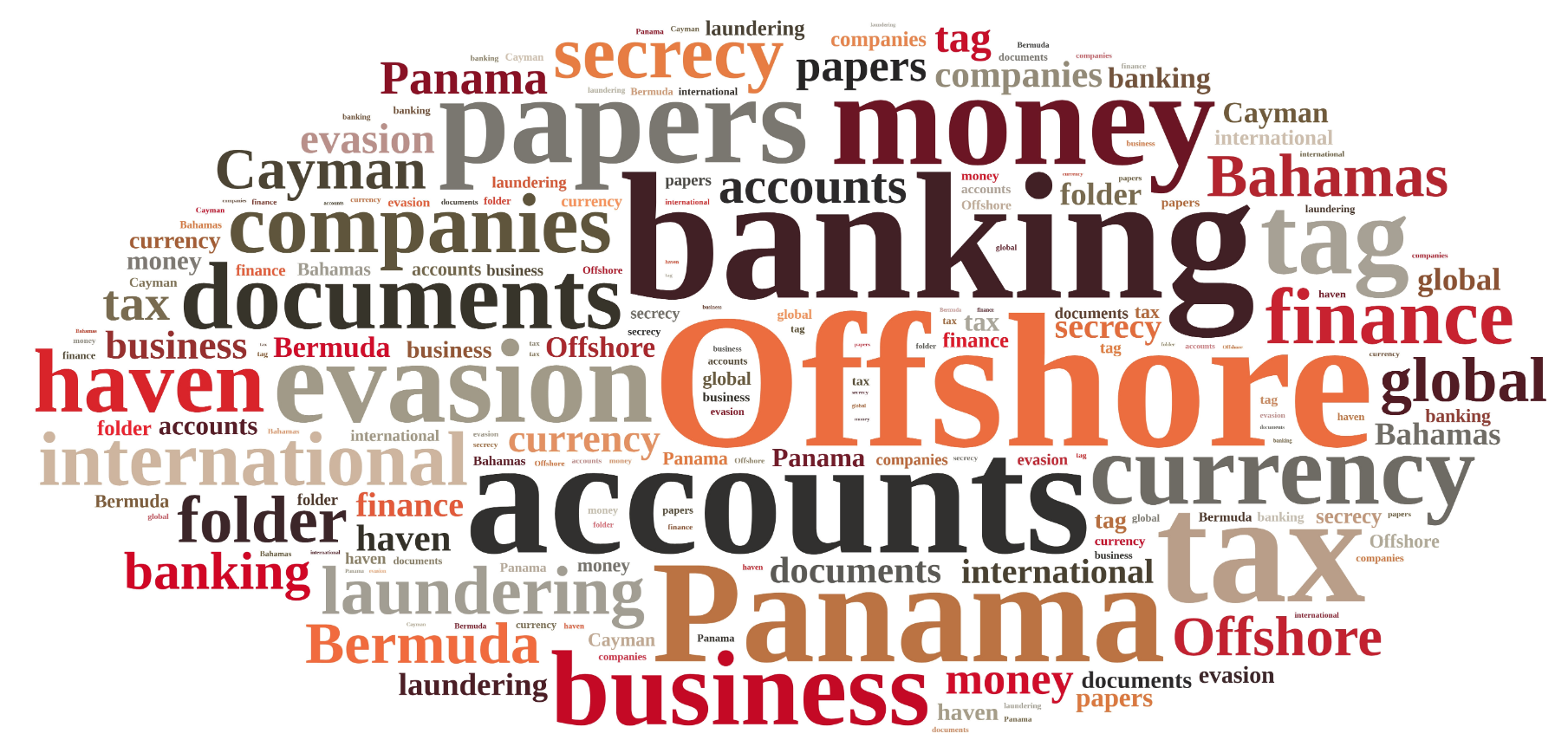

A recent The Irish Times report shows that recorded money laundering crimes more than doubled since the start of Covid-19 compared to the previous year.

524 money-laundering crimes were recorded in 2020, up from 234 in 2019. There were only 83 money laundering offences reported in 2018, and less than 50 a year between 2012 and 2017.

The Garda and Revenue Commissioners received 28,865 suspicious transaction reports (STRs) in 2020. The Revenue state that the yield from compliance interventions directly linked to STRs was €1.6 million.

The number of STRs represents a 13 per cent increase on the 2019 total. This trend represents the changing face of crime in Ireland, more of which is taking place online.

Are you up to date with your Anti-Money Laundering (AML) responsibilities? The law changed on 23 April and we have published our latest AML Policies, Controls & Procedures Manual for 2021.

The Manual follows the enactment of the Criminal Justice (Money Laundering and Terrorist Financing) Acts 2010 to 2021 now fully in force. Future blogs will look at various parts of the new and existing provisions of this legislation.

For more blogs please visit this link and for our publications and manuals and services click here.

by John McCarthy Consulting Ltd. | May 4, 2021 | Blog, News

Readers of our regular blog will be delighted to hear that our new Anti-Money Laundering & Terrorist Financing Policies Controls & Procedures Manual is just published and available here on our website for immediate download. This is the first available 2021 AML Manual for Accountants on the Irish market.

The Manual follows the enactment of the Criminal Justice (Money Laundering and Terrorist Financing) Acts 2010 to 2021 which has come into effect on two dates:

- 23 April 2021 for all parts of the Act except Section 8 dealing with express trusts; and

- 24 April 2021 – Section 8 is enacted requiring express trusts to keep a beneficial ownership register.

In future blogs we will look at various parts of the new and existing provisions of this legislation.

For more blogs please visit this link and for our publications and manuals and services click here.

by John McCarthy Consulting Ltd. | Apr 13, 2021 | Blog, News

In our last blog, we mentioned the enactment of the latest AML legislation in Ireland which is the ‘Criminal Justice (Money Laundering and Terrorist Financing) (Amendment) Act, 2021’. In the coming weeks we are going to take a look at the various provisions of the new legislation.

Among the provisions of the new Act is one that amends Schedule 4 of the Act of 2010 to specify further red flags, for transactions that could pose a higher risk of money laundering and/or terrorist financing. The 2021 law is yet to be commenced by statutory instrument.

A higher risk is posed where:

- a customer is a third-country national who applies for residence rights or citizenship in the State in exchange for capital transfers, purchase of property or government bonds, or investment in corporate entities in the State;

- a product, service, transaction or delivery channel involves the use of non-face-to-face business relationships without the use of certain safeguards such as electronic identification means, relevant trust services or other secure, remote or electronic, identification processes that are officially regulated, recognised, approved or accepted;

- a transaction relates to oil, arms, precious metals, tobacco products, cultural artefacts and items of archaeological, historical, cultural and religious importance, or of rare or scientific value, including ivory and protected species.

For more blogs please visit this link and for our publications and manuals and services click here.