by John McCarthy Consulting Ltd. | Oct 12, 2020 | Blog, News

Are your engagement letters up to date?

Once upon a time it was possible to have the same client engagement letter in place for several years, without too much upset.

However, the pace of change in the various pieces of overlapping legislation (much of it of a whistleblowing nature) that impact on engagement letters, seems to be getting faster and faster. Different obligations under criminal law, tax law, company law and anti-money laundering that are now required in the typical contract with your client, mean that there is a never ending requirement to review your letters and issue revised and updated letters to your clients on an annual basis.

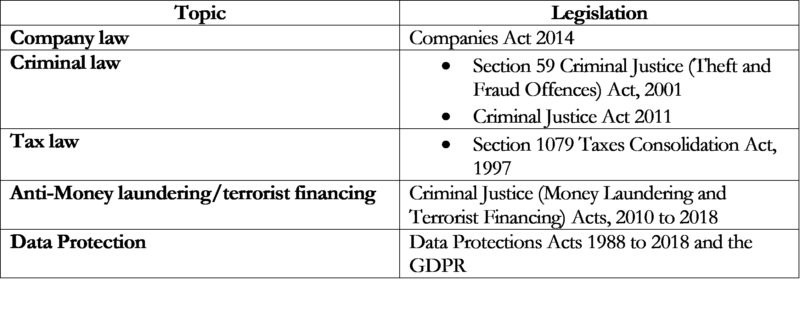

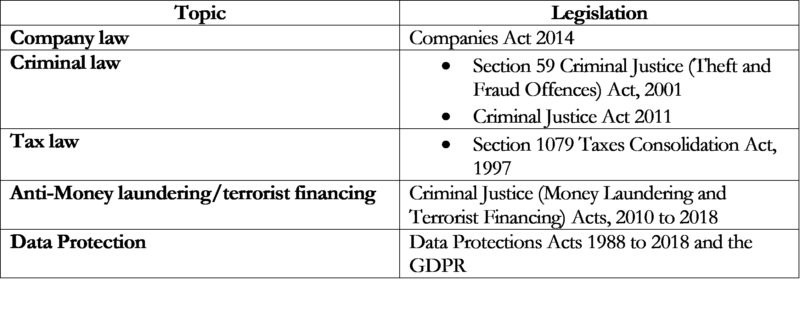

Here is a quick checklist of the legislation you need to include in audit engagement letters:

Audit engagement letter under the Companies Act 2014:

In future issues of this blog, we will cover the typical legislative references required in engagement letters for other entities including specialised ones like solicitor clients (reporting under the Solicitors Accounts Regulations of the Law Society), auctioneers, owners management companies, charities and insurance intermediaries.

by John McCarthy Consulting Ltd. | Sep 29, 2020 | Blog, News

The Charities Governance Code Explained

In the last few weeks we have covered several topics in relation to Charities in Ireland arising from the 2019 Charities Regulator Report published in the summer.

We have covered the Types of Charities and Charities by the Numbers.

This week we will look at the Charities Governance Code (the Code). The Code explains the minimum standards required to effectively manage and control all registered charities in Ireland. These standards must be applied from 2020. The first year that registered charities will be expected to report on their compliance with the Code will be 2021.

The Governance Code is structured with two main types of charity in mind:

- volunteer-only charities and

- charities with a small number of paid staff

as these types of charity reflect the majority of registered charities in Ireland.

The Code is tailored to encourage charities of all sizes to have better administration, financial and management systems in place. Underpinning the Six Principles are two main types of standard (depending upon the size and complexity of charities) which are

- the ‘core standards’ (of which there are 32 in total) that all charities must apply (including the charity’s main purpose, whether any private benefit arises, goal setting to raise funds, annual review), and

- ‘additional standards’ that only certain charities need apply (including developing strategic and operational plans).

The six principles of governance that all charities must apply are:

- Advancing charitable purpose – how the charity fits into one or more of the four categories of ‘charitable purpose’ as defined in the Charities Act, 2009;

- Behaving with integrity – setting an ethical culture and tone;

- Leading People – providing leadership to volunteers, employees and contractors;

- Exercising control – putting mechanisms in place to abide by all legal and regulatory requirements

- Working effectively – induction training for Board members and running efficient Board meetings, having people with the right mix of skills and experience; and

- Being accountable and transparent – accounting for the money (including producing unabridged financial statements) and being open/transparent about all charity matters.

Who is the Code for?

The Governance Code document should be used by all trustees of any kind of charity, being:

- Committee members;

- Council members; and

- Board members or directors of the charity.

How should the Code be used?

Trustees should make themselves familiar with the six principles of the Code and should consider them when assessing compliance with actions taken within the charity and ensure that documentary evidence is kept demonstrating how the standards are met.

Reporting Compliance

From 2021 every charity must submit an annual return to the Charities Regulator demonstrating compliance with the Code and providing valid reasons for non-compliance.

Charities will use a 20 page Compliance Record Form identifying actions taken to meet the Governance Code standards, while the amount of evidence expected to support the level of compliance will vary, depending on the size and complexity of the charity.

The guide to the Governance Code with which all trustees should be familiar, is available here.

New to our website this week are five engagement letter templates:

Our Charity Accounting and Charity Audit webinars are available here for immediate access and come with much support material as an extra free bonus and we have several audit template letters for charities that are up to date for SORP, GDPR and Coronavirus (COVID-19), downloadable for immediate tailoring in MS Word.

For a full list of all our webinar recordings, please go to our webinar site here. They may be viewed at any time for 12 months after the date of purchase.

We also have a complete set of charities’ letters of representation in our publications store, updated for SORP and Coronavirus (COVID-19), and letters of engagement for immediate download here. There are also versions available for charities that are not yet implementing the SORP.

by John McCarthy Consulting Ltd. | Sep 13, 2020 | Blog, News

Charities Regulator Report by the Numbers

As we saw in last weeks’ blog there is a wide variety of charity on the Register of Charities in Ireland.

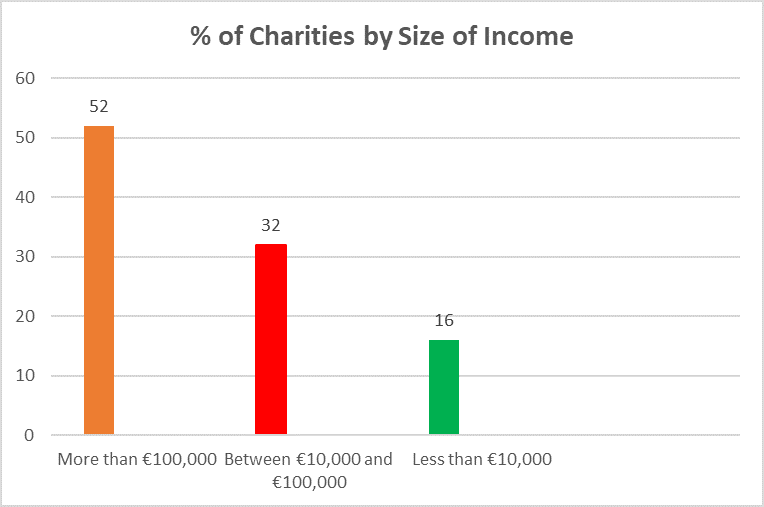

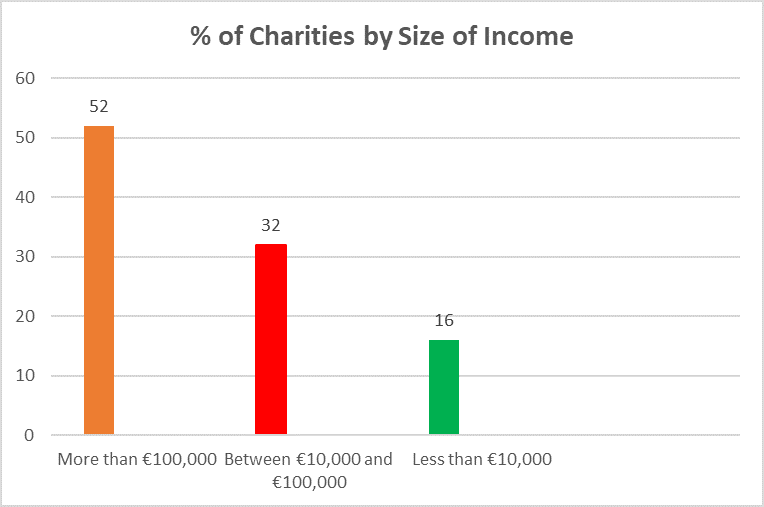

This week we look at the percentage of charities by income and numbers of employees.

Charities by Income

52% of charities had annual income of more than €100,000, 32% had annual income of between €10,000 and €100,000 while there was a sizeable 16% of charities with income per annum of less than €10,000.

Within the 2,165 charities reporting an annual income of over €250,000 in 2019, 875 (40%) had income in excess of €1 million.

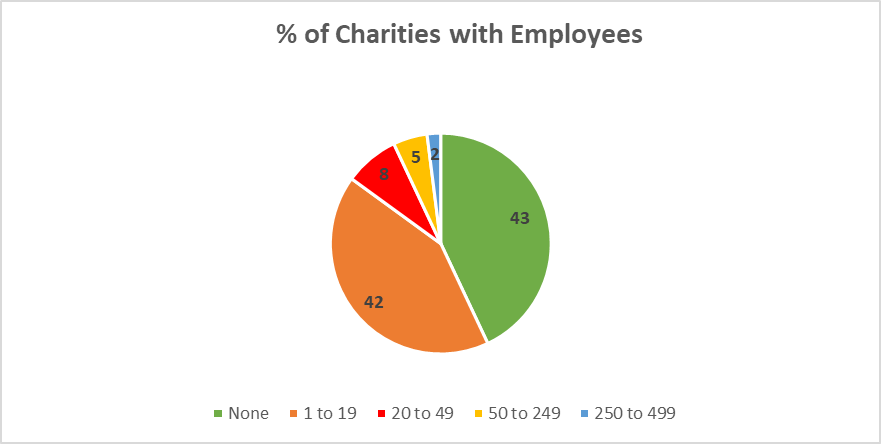

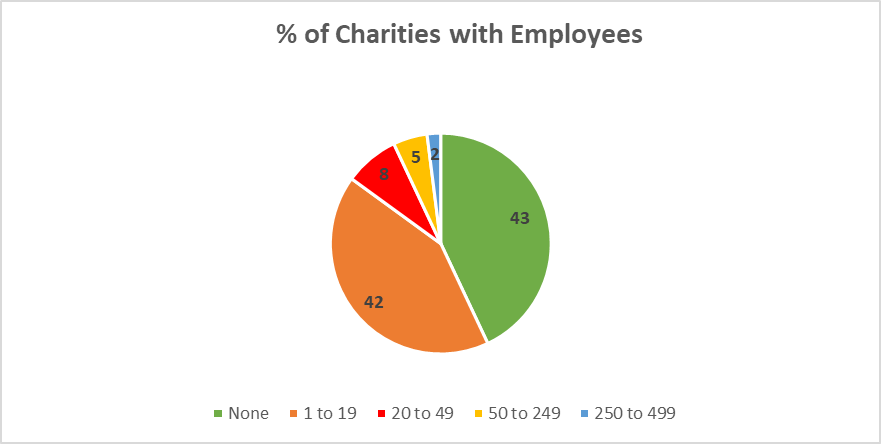

Charities by Employee Numbers

43% of charities had no employees. 42% reported having between 1-19 employees, 8% had between 20-49, 5% had 50-249, while 2% had between 250-499.

The 2019 Charities Regulator Annual Report can be found here.

Our Charity Accounting and Charity Audit webinars are available here for immediate access and come with much support material as an extra free bonus.

We also have several audit template letters for charities that are up to date for FRS 102 SORP, GDPR and Coronavirus (COVID-19) downloadable for immediate tailoring in MS Word.

For a full list of all our webinar recordings, please go to our webinar site here. They may be viewed at any time for 12 months after the date of purchase.

We also have a complete set of charities letters of representation in our publications store, updated for SORP and Coronavirus (COVID-19), and letters of engagement for immediate download here. There are also versions available for charities not yet implementing the SORP.

by John McCarthy Consulting Ltd. | Sep 7, 2020 | Blog, News

Charities Regulator Report

The number of charities registered in Ireland passed the 10,000 mark in 2019 (the actual number was 10,514), according to the Charities Regulator which published its annual report in July 2020.

The Register of Charities

The 10,514 charities on the public Register of Charities at the end of 2019 is an increase of 715 (7%) on 2018. There were 67,129 charity trustees on the Register of Charities at 31 December 2019, up 10% on the previous year. Charity trustees include committee members and company directors who ultimately exercise control and have legal responsibility for running charities.

Points of note from the 2019 Annual Report are:

The most common charitable purposes of registered charities in 2019 were:

- Benefit to the community 54%,

- Advancement of education 30%

- Relief of poverty/economic hardship 9%

- Religion 7%

Breakdown of charities

- Incorporated companies 44%

- Unincorporated entities:

- Associations 15%

- Boards of Management (Schools/other) 27%

- Other 8%

- Charitable Trusts 6%

The full list of the Irish registered Charities can be accessed here on the Register of Charities:

The 2019 Charities Regulator Annual Report can be found here

Our Charity Accounting and Charity Audit webinars are available here for immediate access and come with much support material as an extra free bonus.

We also have several audit template letters for charities that are up to date for SORP, GDPR and Coronavirus (COVID-19) downloadable for immediate tailoring in MS Word.

For a full list of all our webinar recordings, please go to our webinar site here. They may be viewed at any time for 12 months after the date of purchase.

We also have a complete set of charities letters of representation in our publications store, updated for SORP and Coronavirus (COVID-19), and letters of engagement for immediate download here. There are also versions available for charities not yet implementing the SORP.

by John McCarthy Consulting Ltd. | Sep 5, 2020 | Blog, News

How is Your Insolvency Compliance?

In previous weeks’ blogs we wrote about the recent publication of the 2019 Annual Report of the Chartered Accountants Regulatory Board (CARB). This week we look at the results of Insolvency Compliance inspections.

Of the insolvency inspections completed in the Republic of Ireland in 2019, 26% were not satisfactory. Often the issues arising are procedural and firms may be lacking a system of internal quality control reviews, especially of senior partner insolvency work.

John McCarthy Consulting Limited regularly carries out such reviews.

We prepare a written report on our assessment of the process evidenced by a sample of the Insolvency Practitioners’ files for the following:

- Initial and Appointment procedures, whether they be for Creditors/Members Liquidations, Receiverships or Examinerships.

- Compliance with the Anti-Money Laundering legislation

- Internal Review Systems

- Financial controls and Clients Money Bank Accounts

- Compliance with the Statements of Insolvency Practice

- Treatment of fees

- Directors’ conduct reports to the ODCE

- Statutory returns

- Case progression and finally

- The efficiency of the Case closure process.

The review will also include an informal comparison with the firm’s peers in the sector providing valuable feedback on the latest best practice, along with feedback from recent inspection results.

We also carry out similar reviews with valuable feedback for audit and anti-money laundering purposes.

For a full list of all our webinar recordings, please go to our webinar site here. They may be viewed at any time for 12 months after the date of purchase.

We also have a complete set of letters of representation in our publications store, updated for Coronavirus (COVID-19), and letters of engagement for immediate download here.

by John McCarthy Consulting Ltd. | Aug 29, 2020 | Blog, News

How is your AML Compliance?

In last week’s blog we wrote about the recent publication of the 2019 Annual Report of the Chartered Accountants Regulatory Board (CARB). The section on Money Laundering inspections will be of interest to readers.

Money Laundering Compliance Review – Every firm is required to perform an annual money laundering compliance review and document it, with findings for follow-up action. The review should involve a thorough examination of the firm’s AML procedures, including their application on client files, a review of the firm’s AML Policies & Procedures Manual and a review of AML training within the firm. Firms are also required to have prepared and documented a Firm Wide Business Risk Assessment.

During any subsequent Institute inspection the remedial action, identified in the firm’s review, will be expected to have been completed or substantially progressed.

AML Training – Firms must have procedures to monitor that all personnel involved in client work (not just client facing staff) receive up to date AML training.

Annual Return declarations – Firms must complete their annual returns every year. Often the AML section has errors. The Quality Assurance Committee of the Institute, to which the Professional Standard Department reports, takes incorrect declarations on the Annual Return very seriously and regulatory penalties can result where inaccuracies are identified during an inspection.

Our February 2020 up to date AML Policies & Procedures Manual is available on our site for immediate download in Word format and it contains everything you need to be up to date.

We also have several audit template letters that are up to date for GDPR and Coronavirus (COVID-19) downloadable for immediate tailoring in MS Word.

For a full list of all our webinar recordings, please go to our webinar site here. They may be viewed at any time for 12 months after the date of purchase.

We also have a complete set of letters of representation in our publications store, updated for Coronavirus (COVID-19), and letters of engagement for immediate download here.