by John McCarthy Consulting Ltd. | Aug 20, 2021 | Blog, News

This is our third and final blog about the results of audit monitoring inspections during the Pandemic.

In Part 2 last week, we looked at going concern (ISA 570), subsequent events (ISA 560) and the lack of financial statement disclosures regarding COVID.

In Part 1 two weeks ago, we looked at stock attendance (ISA 501), fraud (ISA 240) and accounting systems and controls (ISA 315).

Other matters that we have seen on cold file reviews and on recent audit monitoring visits include:

Walk-through testing

Walk through tests that appear on audit files often start from within the client’s accounting system which is the wrong place to start. For walk through tests to be fully effective, they need to commence outside the main system i.e., at the authorisation stage for purchases, at the customer order stage for sales, using clock cards, timesheets and/or employment contracts for wages etc.

Ethical Standards for Auditors

The new IAASA Ethical Standards for Auditors (Ireland) 2020 are effective from 15 July 2021.

Sometimes auditors do not appreciate the implications of certain ethical standards which require appropriate safeguards to mitigate the threats posed. The most common threats we see are Long Association with Audit Engagements (audit partner in place for 10+years) and Provision of Non-Audit Services (especially for the provision of accounting, tax and company secretarial services). Firms are reminded to review the Ethical Standards (Sections 3 and 5 respectively) to ensure they have dealt appropriately with the threats and identified/implemented relevant safeguards. Quite often the only practical safeguard for sole practitioners with a long association problem is to arrange for an annual hot issue or a hot file review (also known as an Engagement Quality Control Review (EQC Review) in year 11 onwards. The implementation of safeguards needs to be properly documented.

It may be possible to apply Provisions Available for Audits of Small Entities (Section 6 PAASE) to deal with threats arising from economic dependence or where tax or accounting services are provided to certain ‘small’ entities, as defined in Section 6. Where PAASE is applied, two matters arise:

- the auditors’ report must disclose this fact and

- either the financial statements notes or the auditors’ report must include the relevant disclosures specified in ES PAASE para 6.15(b).

Small Companies Exemption Incorrectly Claimed – Schedule 5 Companies Act 2014

A reminder that entities listed in Schedule 5, Companies Act 2014 are deemed ‘large’ and often include entities regulated by the Central Bank of Ireland (e.g., ‘insurance intermediaries’). Please note that such entities cannot:

- Use FRS 102 Section 1A (which is only for certain ‘small’ entities;

- Use the Provisions Available for Audits of Small Entities;

- Avail of small companies’ audit exemption; and

- File abridged financial statements with the CRO.

Such companies must also produce a Statement of Cash Flows and disclose the remuneration of their auditors in four stated categories (for the current/prior years) for:

- audit of the company/group;

- other assurance services;

- tax advisory services; and

- other non-audit services.

For bespoke training on any of the topics mentioned here, please see our website.

by John McCarthy Consulting Ltd. | Aug 13, 2021 | Blog, News

This is Part 2 of our series of three blogs about the impact that the Coronavirus (COVID-19) is having on evidencing of audit work.

In Part 1 last week, we looked at issues like stock attendance (ISA 501), fraud (ISA 240) and accounting systems and controls (ISA 315). Here are some other problem areas seen during recent audit monitoring inspections.

Going concern (ISA 570)

Going concern has always been a key audit area and remains so, particularly at the moment. Monitoring inspectors often see excellent examples of audit work on going concern including consideration of worst case scenarios when assessing forecasts, and good documentation of the thought processes supporting the auditor’s conclusions on this topic. This will include evidence of scepticism and challenge of management’s assumptions.

In other cases with less than ideal inspection outcomes, audit work on going concern may have been carried out but inadequately documented, or in some cases insufficient audit work on going concern is performed. Areas giving rise to findings on monitoring visits include lack of, or insufficient challenge and assessment of management assumptions or the lack of alternative audit procedures on the audit file, where for example formal future cash flow forecasts are not prepared, particularly on smaller clients. These need to be on file for a period of at least 12 months from the date of sign-off of the financial statements.

Please remember ISA 570 (Revised) (effective for audits of financial statements for periods commencing on or after 15 December 2019) contains increased requirements in relation to audit work on going concern.

Subsequent events (ISA 560)

Inspectors also see cases where there has been a delay in signing some financial statements due to the Pandemic. Don’t forget to ensure that appropriate subsequent events procedures are performed up to the date of the auditor’s report in such circumstances. This should include details of the date/time/place and names of those attending the final close off meeting, even if this s a brief 5-minute phone call. The notes should also contain details of action points agreed and matters forward to the next audit.

Financial Statement disclosures – COVID

There are often comprehensive disclosure in financial statements regarding the impact of COVID. Unfortunately in other cases, there are only brief or no disclosures.

Even where the directors consider COVID has had no impact on the entity, it may still be appropriate to include disclosure in the financial statements to that effect. Disclosure should be sufficient to enable the reader of the financial statements to understand why the directors believe this to be the case. Information disclosed in the directors’ report must be consistent with the information disclosed in the financial statements.

See the final Part 3 of this blog next week.

by John McCarthy Consulting Ltd. | Aug 3, 2021 | Blog, News

The Coronavirus (COVID-19) has caused auditors to develop new techniques in carrying out their audit work, mainly involving greater use of technology. In this, the first blog of our three-part series, we will look at some recent audit monitoring inspection reports that have highlighted the most common problem areas for auditors.

Stock Attendance (ISA 501)

Many firms have not been able to attend clients’ premises for inventory counts. In these circumstances the auditor must attempt to perform alternative procedures e.g., where the client takes a live video call from the auditor and ‘walks’ the auditor remotely through the stock count location. Details of alternative procedures like this, and the auditors’ conclusions following the procedures, must be documented on the audit file. If adequate alternative procedures cannot be performed the audit file needs to document a consideration of the impact on the auditor’s report.

Where audit clients have not traded for significant periods of time, the audit file needs to show some consideration of potential stock impairment or obsolescence. A sceptical approach by auditors is always prudent. The ICAS has issues excellent guidance on attendance at stocktakes during the coronavirus outbreak. It’s worth looking at.

Fraud (ISA 240)

Audit files should fully document consideration of fraud (including the scope for fraud involving Government Covid subsidies/grants), especially where the audit firm may not have direct access to its audit client and/or where audit clients may not have direct access to their customers.

Common findings on monitoring visits include poor or inadequate completion of fraud checklists with no additional consideration documented regarding:

- fraud risk assessment;

- insufficient documentation of discussions between the auditor and management;

- lack of evidence of the auditor’s assessment of fraud and

- lack of evidence of the auditor’s conclusions regarding fraud risk.

Accounting systems and controls (ISA 315)

The Coronavirus (COVID-19) has challenged client’s accounting systems and controls like nothing has ever before.

Audit firms need to consider whether the audit clients’ accounting systems and controls remain appropriate during Covid-19, especially with few or no client staff working from their office location. A common failing at monitoring visits is the carrying forward of systems notes from prior years with little evidence of written assessment of the impact of the Coronavirus on the accounting systems and controls. The notes on file must take account of the impact on the client’s operations of remote working and/trading in an online environment.

See Part 2 of this blog next week.

by John McCarthy Consulting Ltd. | Sep 29, 2020 | Blog, News

The Charities Governance Code Explained

In the last few weeks we have covered several topics in relation to Charities in Ireland arising from the 2019 Charities Regulator Report published in the summer.

We have covered the Types of Charities and Charities by the Numbers.

This week we will look at the Charities Governance Code (the Code). The Code explains the minimum standards required to effectively manage and control all registered charities in Ireland. These standards must be applied from 2020. The first year that registered charities will be expected to report on their compliance with the Code will be 2021.

The Governance Code is structured with two main types of charity in mind:

- volunteer-only charities and

- charities with a small number of paid staff

as these types of charity reflect the majority of registered charities in Ireland.

The Code is tailored to encourage charities of all sizes to have better administration, financial and management systems in place. Underpinning the Six Principles are two main types of standard (depending upon the size and complexity of charities) which are

- the ‘core standards’ (of which there are 32 in total) that all charities must apply (including the charity’s main purpose, whether any private benefit arises, goal setting to raise funds, annual review), and

- ‘additional standards’ that only certain charities need apply (including developing strategic and operational plans).

The six principles of governance that all charities must apply are:

- Advancing charitable purpose – how the charity fits into one or more of the four categories of ‘charitable purpose’ as defined in the Charities Act, 2009;

- Behaving with integrity – setting an ethical culture and tone;

- Leading People – providing leadership to volunteers, employees and contractors;

- Exercising control – putting mechanisms in place to abide by all legal and regulatory requirements

- Working effectively – induction training for Board members and running efficient Board meetings, having people with the right mix of skills and experience; and

- Being accountable and transparent – accounting for the money (including producing unabridged financial statements) and being open/transparent about all charity matters.

Who is the Code for?

The Governance Code document should be used by all trustees of any kind of charity, being:

- Committee members;

- Council members; and

- Board members or directors of the charity.

How should the Code be used?

Trustees should make themselves familiar with the six principles of the Code and should consider them when assessing compliance with actions taken within the charity and ensure that documentary evidence is kept demonstrating how the standards are met.

Reporting Compliance

From 2021 every charity must submit an annual return to the Charities Regulator demonstrating compliance with the Code and providing valid reasons for non-compliance.

Charities will use a 20 page Compliance Record Form identifying actions taken to meet the Governance Code standards, while the amount of evidence expected to support the level of compliance will vary, depending on the size and complexity of the charity.

The guide to the Governance Code with which all trustees should be familiar, is available here.

New to our website this week are five engagement letter templates:

Our Charity Accounting and Charity Audit webinars are available here for immediate access and come with much support material as an extra free bonus and we have several audit template letters for charities that are up to date for SORP, GDPR and Coronavirus (COVID-19), downloadable for immediate tailoring in MS Word.

For a full list of all our webinar recordings, please go to our webinar site here. They may be viewed at any time for 12 months after the date of purchase.

We also have a complete set of charities’ letters of representation in our publications store, updated for SORP and Coronavirus (COVID-19), and letters of engagement for immediate download here. There are also versions available for charities that are not yet implementing the SORP.

by John McCarthy Consulting Ltd. | Sep 13, 2020 | Blog, News

Charities Regulator Report by the Numbers

As we saw in last weeks’ blog there is a wide variety of charity on the Register of Charities in Ireland.

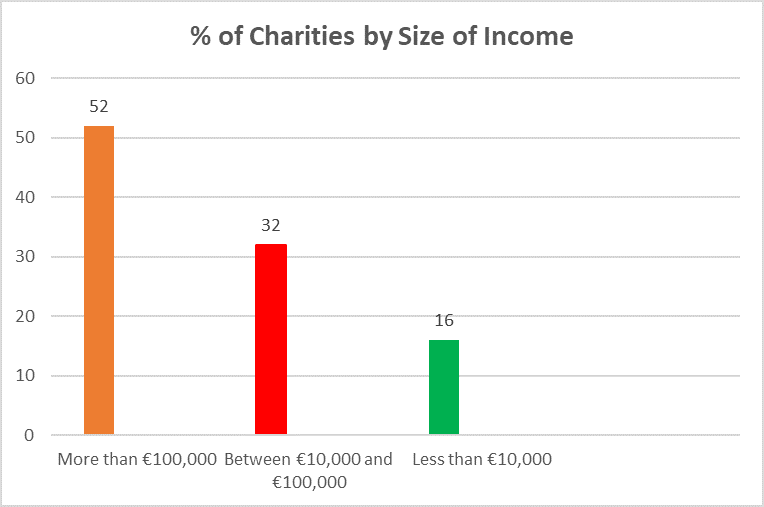

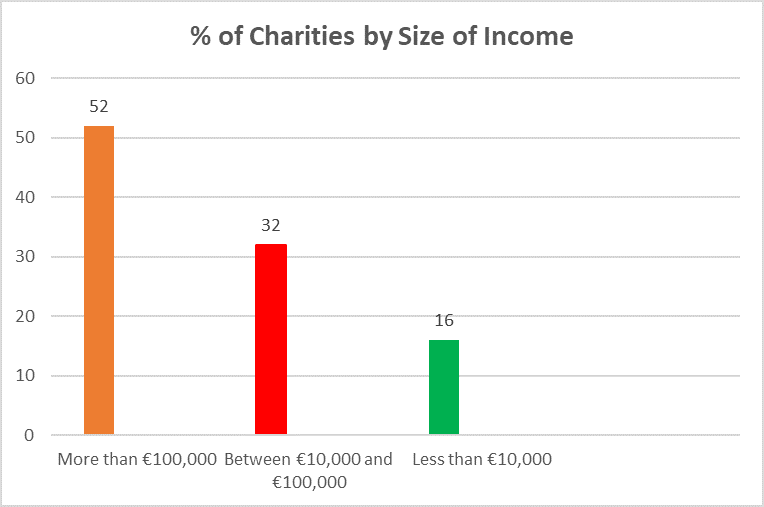

This week we look at the percentage of charities by income and numbers of employees.

Charities by Income

52% of charities had annual income of more than €100,000, 32% had annual income of between €10,000 and €100,000 while there was a sizeable 16% of charities with income per annum of less than €10,000.

Within the 2,165 charities reporting an annual income of over €250,000 in 2019, 875 (40%) had income in excess of €1 million.

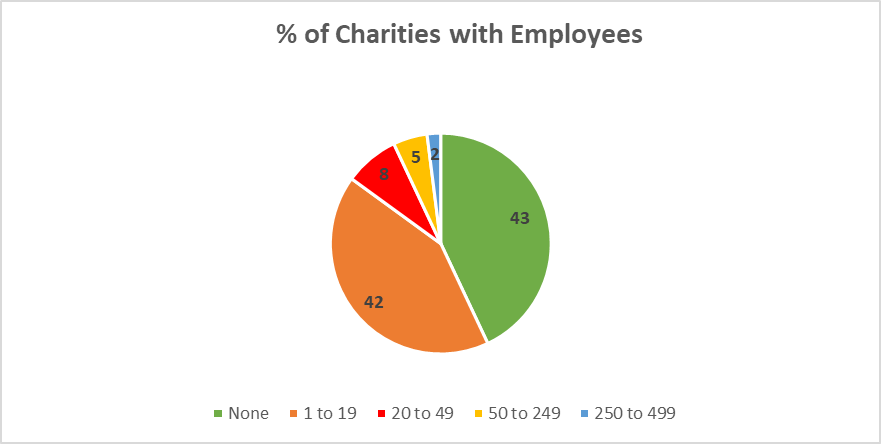

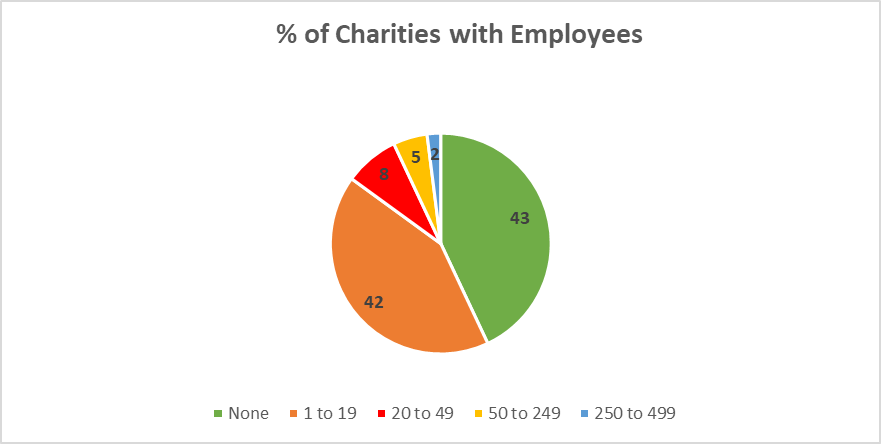

Charities by Employee Numbers

43% of charities had no employees. 42% reported having between 1-19 employees, 8% had between 20-49, 5% had 50-249, while 2% had between 250-499.

The 2019 Charities Regulator Annual Report can be found here.

Our Charity Accounting and Charity Audit webinars are available here for immediate access and come with much support material as an extra free bonus.

We also have several audit template letters for charities that are up to date for FRS 102 SORP, GDPR and Coronavirus (COVID-19) downloadable for immediate tailoring in MS Word.

For a full list of all our webinar recordings, please go to our webinar site here. They may be viewed at any time for 12 months after the date of purchase.

We also have a complete set of charities letters of representation in our publications store, updated for SORP and Coronavirus (COVID-19), and letters of engagement for immediate download here. There are also versions available for charities not yet implementing the SORP.