by John McCarthy Consulting Ltd. | Oct 16, 2014 | News

It would seem fair to assume that after eleven years the profession has got to grips with the anti-money laundering (AML) regulations. However they remain one of the key problem areas encountered on regulatory inspections.

Perhaps the obvious reason for failing to focus on AML procedures is that firms can’t raise a fee note for such work. Some view AML as an unwelcome and onerous regulation that puts barriers in the way of helping clients, and adds no value. Consequently, some firms give scant attention to AML procedures.

However, AML regulations are a global reality, one that firms have to get to grips with. If you establish appropriate procedures, they do not need to be regarded as onerous.

Long-established clients

There was an exemption in the implementation of the Criminal Justice Act, 1994 (that came into effect for accountancy firms in the Republic of Ireland from 15 September, 2003) that meant that customer due diligence (ID checks) were not required for clients in place at that date. However, the subsequent 2010 legislation removed that same exemption. A further piece of legislation called the Criminal Justice Act, 2013 updates certain parts of the 2010 law.

The 2010 law, called the ‘Criminal Justice (Money Laundering and Terrorist Financing) Act, 2010’, came into effect from 15 July 2010 and abolished the 1994 law while it re-implemented most of its requirements and added others. Firms should now therefore have due diligence for every client and retain that documentation for at least five years after the last business transaction with that client. See the latest guidance from the professional accountancy bodies at the Consultative Committee of Accountancy Bodies – Ireland, (CAAB-I), ‘ Anti-Money Laundering Procedures Republic of Ireland’ dated September 2010. (http://www.cmf.ie/picts/Anti-Money%20laundering%20procedures%20ROI.pdf)

In many cases firms will have documentation that will satisfy the due diligence requirements (e.g. a Revenue Commissioners tax demand or Department of Social Protection correspondence and details of a client’s personal bank statement or pension scheme). If this is not the case simply ask to see your client’s photo-driving licence and take a copy, or use some other form of electronic verification to get the evidence you need, using sources like C6 (http://www.c6-intelligence.com/) or Veriphy (http://www.veriphy.co.uk/), provided the client is assessed as ‘low’ risk. Politically Exposed Persons (PEPs) as defined in the legislation (which includes relatives and business associates of such persons) must be specifically identified and treated as high risk, which means additional evidence and explanations must be documented about their financial transactions and sources of wealth. Legislation is expected in 2015 to expand the definition of PEPs to include locally resident persons who are politically exposed.

Risk assessment

The customer due diligence procedures should be risk-based. While most firms complete some form of risk assessment, many go on to ignore it with regards to the amount of AML checking they undertake. This often leads to excessive checking for some clients and insufficient checking for others. Forms need to be completed to document the risk assessment and evidence gathering process and to show its subsequent regular review and action taken, following review.

Beneficial ownership

For most clients, this is not an issue as their structure is simple and ownership is clear. However, it can be a major issue when you have structures involving anonymity, such as trusts or companies in Panama, Delaware BVI and Cayman Islands, or other offshore as well as some onshore territories using ‘bearer shares’ (the latter regarded as ‘high’ risk).

The legislation requires any client using anonymous structures or clients that you have not met face to face, to be treated as high risk. You must have the same level of identification for high risk beneficial shareholders as you do for the client’s principals/directors. Without evidence to support this beneficial ownership you cannot act and continuing to do so may lead not only to breach of the legislation but also to unnecessary professional indemnity risks.

Keeping information up to date

Often firms might have done a blitz when the new laws first came in, in 2003 or 2010, but have done little since. You must regularly review the evidence you have to confirm that it is still accurate and up to date. If there have been changes in ownership, the principals or the nature of the business then you must update your records. If everything is still valid, no updates are necessary.

Training

The regulations require staff to receive training and evidence must be retained that the staff have understood the training (so some form of written quiz is necessary). This should form part of your induction programme for all new staff. You also have to provide ongoing training to staff in recognising and dealing with suspicious transactions and keep records of these regular updates and the names of staff attending.

Conclusion

AML regulations are here to stay and failure to comply can have regulatory consequences. Therefore, it makes sense to implement procedures to ensure compliance, but with the minimum effort required.

For more information contact John at 00 353 86 839 8360 or at john@jmcc.ie

by John McCarthy Consulting Ltd. | Aug 17, 2014 | News

In the brief video attached I want to highlight some of the many tax implications that will arise for preparers of the first financial statements under the new Irish GAAP for the calendar year 2015.

(more…)

by John McCarthy Consulting Ltd. | Jul 22, 2014 | News

Why make two moves, when one will do?

Some reaction to our last blog piece – “Will FRS 102 have an impact on my clients given their small size?” Well the answer is Yes. For some reason the demise of the FRSSE has attracted very little attention in Ireland – perhaps it’s because there has been very little uptake of FRSSE in the Republic of Ireland in the past, mainly because of our historically low ‘small’ and ‘medium’ company size thresholds.

Many accountants were hoping it was safe to move their ‘small’’ companies onto this standard in January 2015 but they will not do so now if they have to move again soon afterwards to FRS 102 or FRS 102 Lite. Why make two moves, when one will do?

The demise of the FRSSE was announced by the Financial Reporting Council standard setter in their June 2014 newsletter ‘Setting the Standard’. This will mean that FRS 102 is soon to be the accounting standard for almost all private companies, possibly with the exception of micro companies, that satisfy certain criteria.

The newsletter provides an update on the FRC’s plans for the future of the FRSSE in the light of the significant changes to the small companies regime that are expected to take place when the new EU Accounting Directive is implemented – expected to be by the Summer of 2015.

The FRC has concluded that retaining the FRSSE in its current form is not a realistic option. Their latest thinking is that:

- the FRSSE will be withdrawn;

- small entities will be brought within the scope of FRS 102 with reduced disclosures; and (some call this FRS 102 ‘Lite’)

- there will be a separate standalone standard for micro-entities – to be known as the Financial Reporting Standard for Micro-entities or FRSME – which will be based on a micro-entities regime (already introduced in the UK and due to be introduced in the Republic of Ireland some-time soon) and may include additional recognition and measurement simplifications appropriate to the very smallest entities.

The FRC expect to issue a high-level consultation on these proposals this summer. After considering the feedback to the consultation document, the FRC will issue an exposure draft setting out its proposals in more detail. These, more detailed, proposals are expected towards the end of 2014.

So its hello FRS 102 and farewell FRSSE.

by John McCarthy Consulting Ltd. | Jul 9, 2014 | News

Nine Key Differences Between Current Irish/UK GAAP and FRS 102

Introduction

The article examines the more common areas of difference between the existing Irish/UK GAAP i.e. the existing FRSs/SSAPs and UITF (Urgent Issues Task Force) pronouncements and new Irish GAAP. The new Irish/UK GAAP is called FRS 102 and it comes into force for accounting periods commencing on or after 1 January 2015.

Background to the Development of FRS 102

The Financial Reporting Council (FRC), or the Accounting Standards Board (ASB) as they were previously known until July 2012, commenced a project to replace Irish and UK GAAP about ten years ago. This went through various iterations including a version of the IFRS for SMEs which was later transformed into the ‘FRSME’ (FRS for Medium Entities) published in late 2009. However following wide scale feedback from the profession and from users of financial statements, FRS 102 was ‘born’. Copies of the standard are available in the publications section of the FRC website at www.frc.org.uk.

The new FRS was published in March 2013 preceded by two accompanying standards, FRS100 and FRS 101 (both published in November 2012) which also need to be read for a full understanding of the application of the standard. The complete titles of the new standards are:

· FRS 100 Application of Financial Reporting Requirements

· FRS 101 Reduced Disclosure Framework – Disclosure exemptions from EU –adopted IFRS for qualifying entities

· FRS 102 The Financial Reporting Standard applicable in the UK and Republic of Ireland

These three new standards replace the entire suite of FRSs/SSAPs and UITFs for medium/large private entities in the UK and Ireland.

The ‘transition date’ for companies with a December year end, has already passed since 1 January 2014. In fact 2014 will be a busy year for accountants as two sets of financial statements need to be prepared – one set under Irish/UK GAAP`(the last ever using SSAPs and FRS 1 to 30) and another set under FRS 102 which will act as comparatives for the 2015 financial statements.

Early adoption of the standard was allowed and at least one company that has early adopted the standard is Travelodge UK Limited. It adopted the standard for the financial year ended 31 December 2012 – using FRS 102 to prepare the 2012 accounts as soon as it was published in March 2013.

Small entities and the FRSSE

It was originally intended that ‘small’ entities (i.e. those with turnover of less than €8.8m, gross balance sheet assets less than €4.4m and less than 50 employees) could opt to use the FRSSE (a cut down version of old UK/Irish GAAP).

However, recent developments at EU level (with the announcement of the Micro Entities Directive for companies with turnover less than €700,000, gross balance sheet assets less than €350,000 and less than 10 employees) mean that the FRC are currently re-thinking the whole FRSSE project. While the latest incarnation of the FRSSE is due to apply from 1 January 2015, it now looks like it will be replaced by a version of FRS 102 which some commentators believe may be a type of FRS102 ‘lite’. Only time will tell what the FRC will produce, so watch this space.

Terminology

This article does not deal fully with the many changes in terminology brought about by the implementation of the new standard, but some of them are listed here:

|

Current Irish GAAP Term

|

FRS 102 Term

|

|

Profit and loss account

|

Income statement/statement of comprehensive income

|

|

Balance sheet

|

Statement of financial position

|

|

Cash flow statement

|

Statement of cash flows

|

|

Profit and loss reserves

|

Retained earnings

|

|

Statement of recognised gains and losses

|

Statement of changes in equity

|

|

Minority Interest

|

Non-controlling interest

|

Because the current Irish GAAP terms are retained in Irish and UK company law, the law trumps FRS 102 and we are unlikely to see many companies change these terms.

The main technical differences with which accountants and their clients will have to come to grips, in the next six to 12 months are set out below.

Nine key differences

1. Financial instruments

The single biggest difference between ‘old’ and ‘new’ UK/Irish GAAP is that regarding financial instruments which includes cash, trade debtors and trade creditors. Space does not allow us to go into all the details, but suffice to say that even in a simple company or group, accounting for financial instruments will be more complex than in the past.

For example, an interest free loan (deemed to be a ‘basic’ financial instrument) between two companies or between a director and their company is deemed to be a basic financial instrument which, in certain circumstances, will need to be accounted for at amortised cost. Certain other financial instruments will be accounted for at fair value.

2. Goodwill

Under current Irish GAAP goodwill is dealt with under FRS 10 and purchased intangibles are amortised over their useful life which cannot exceed a maximum period of 20 years, subject to a rebuttable presumption that includes both the demonstrable durability of the business and the feasibility of an annual impairment review.

Under FRS 102, intangibles such as goodwill must be amortised over their useful lives but where the entity cannot make a reliable estimate of the useful life, that period should not exceed 5 years. This will impact entities that have goodwill on their balance sheets and cause amortisation to be accelerated, thus depressing reported reserves.

3. Deferred Taxation

There is a major difference between the treatment of property revaluations between the existing Irish GAAP standard FRS 19 Deferred Tax and the new FRS 102.

FRS 102 has reintroduced the local standard requirements of FRS 16 ‘Current Tax’ and FRS 19 ‘Deferred Tax’ but has added some additional requirements which will, in certain cases, increase the amount of deferred tax reported on company books.

In effect it means that if a company revalues its property it must provide for deferred tax at the tax rate that is expected to apply when the timing difference reverses. The same applies in a fair value exercise during a business combination, deferred tax must be provided on similar grounds. That is an attempt to bring the new UK/Irish standard fairly close to the ‘temporary difference’ approach taken by the IASB (International Accounting Standards Board) in full IFRS.

As above, this will often cause some positive and negative changes in reported reserves under FRS 102 compared to current Irish GAAP.

4. Statement of Cash Flows

This statement is quite different (apart from the change of title) from the Cash Flow Statement in current Irish GAAP, called FRS 1, in that there are only three headings instead of nine. These three headings are – ‘operating’, ‘investing’ and ‘financing’ activities. This means that a number of cash flows will be recorded in different headings by different companies, depending on what choices they make.

For example interest payments, interest receipts and dividend receipts can be recorded under about eight different headings, depending on choice and the standard needs to be referred to for the choices available. Even tax paid has no specific section, although it is expected that most of it will be allocated to ‘operating’ with only capital gains tax being likely to be recorded within the ‘investing’ section.

The movement in cash flow is also different in that the reconciliation is to the increase/decrease in cash and cash equivalents rather than just cash, as in FRS 1. In practice this is unlikely to cause problems as cash equivalents are only short term investments that are highly liquid and held to meet short term commitments rather than for investment purposes.

There is no formal reconciliation of the movement in cash to the movement of net debt as in the current FRS 1 but they should both be reconciled so as to ‘prove’ the statement is correct.

5. Investment Property

Investment properties are initially recorded at cost under FRS 102. Subsequently if a fair value can be measured without undue cost or effort then, it must be fair valued with any gains and losses being reported within the Income Statement (new title for the Profit and Loss Account).

If a fair value cannot be measured reliably then it is accounted for as a normal item of property, plant and equipment, at cost and subjected to depreciation.

This accounting treatment is different from the current SSAP 19 ‘Accounting for Investment Properties’ in a number of respects.

Under SSAP 19 a reporting entity:

· must adopt a revaluation model and not charge depreciation; and

· must record all revaluation gains and losses in reserves and in the Statement of Total Recognised Gains/Losses, not the Profit and Loss Account.

For some entities this will result in potentially greater volatility of future company results as gains/losses on investment property revaluations/devaluations will impact directly on income.

6. Leases

Leases are currently dealt with under SSAP 21. The major difference between SSAP 21 and FRS 102 regarding leasing is in the disclosure requirements.

Under the new FRS, for operating leases, entities must now disclose the total amount of non-cancellable operating lease rentals due right to the end of the contract must be split between the amounts due:

· within one year;

· between two and five years and;

· over five years.

In SSAP 21, only the annual commitments expiring within one year, between two and five years etc. are required to be disclosed.

7. Employee benefits

Under current Irish GAAP, employees’ short term entitlements such as untaken holiday pay, are ignored and rarely accrued. However under FRS 102 the cost of all employee benefits must be recognised:

· as a liability after deducting amounts already paid directly to employees; and

· as an expense, unless the cost can be included within inventories or in the cost of property.

Therefore accruals for employees’ untaken holiday entitlements will need to be accrued, giving rise to a once off reduction in reported profits in the first year of implementation of FRS 102.

These entitlements should be measured at the undiscounted amount of short-term employee benefits expected to be paid in exchange for an employee’s service.

The expected cost of accumulating compensated absences should be recognised when the employees render service and measured at the additional amount the entity expects to pay as a result of the unused entitlement accumulated at the end of the reporting period. These are presented as current liabilities.

8. Foreign currency

Under current Irish GAAP, SSAP 20, the contract rate (the rate of exchange specified in the contract between the parties) may be used. However, under FRS 102, the contract rate is not allowed.

Another totally new concept in FRS 102 is that of the ‘functional currency’ – a definition borrowed from full IFRS. This is defined as the currency of the primary economic environment in which an entity operates.

For many Irish private companies it will be obvious that the Euro will be the functional currency of the company but there are a number of subsidiaries of US multi nationals who have had to record their transactions in a foreign currency as their dominant currency is the dollar. Similarly for many UK based entities their functional currency will be Sterling. For these there will be little change from this adjustment to the definition.

For others it will involve considerable judgement in deciding what an entity’s functional currency is. Under SSAP 20 there was no ‘functional currency’ definition, as records had to be kept in the company’s local (geographical) currency.

9. Specialised activities – agriculture

Current Irish GAAP does not deal with the accounting treatment of specialised activities like agriculture. However, FRS 102 addresses the accounting for biological assets defined as living plants and animals. The treatment suggested is a choice between the ‘cost’ model and ‘fair value’.

Summary

At least in the short term, FRS 102 will create some volatility for most reporting entities.

The sooner accountants and their clients come to grips with the key differences and make sure their financial reporting software and systems are well prepared to cope, the better.

A series of courses is taking place around Ireland, presented by John McCarthy, using journal entries to show how to prepare the first transition adjustments and the first set of FRS 102 financial statements for 2014. For more details of location and booking options visitwww.jmcc.ie/events.

John McCarthy FCA, Dip. IFRS, Dip. Insolvency, Certificate in Irish and UK GAAP is Director of John McCarthy Consulting Limited. He offers consulting and training services to the accounting profession on audit, accounting, insolvency and practice management issues.

He may be contacted at 00 353 86 839 8360 or e mail john@jmcc.ie.

For more information see www.jmcc.ie

by John McCarthy Consulting Ltd. | Jun 18, 2014 | News

Welcome to another of our regular blogs on topical issues for accountants in practice.

Our last blog https://jmcc.ie/d7/node dealt with engagement letters in general and focused on audit and audit exempt engagement letters. This blog targets tax engagement letters specifically.

Engagement letter fundamentals – an important line of defence

Tightening the language used in tax and other engagement letters will help limit your professional liability.

In recent times we have noticed a renewed interest by accountancy firms in having well written and up to date engagement letters reviewed and critiqued by risk management professionals. The objective of this article is to outline the fundamentals of tax and other types of engagement letters and to suggest provisions that will help minimize legal liability faced by accountants in practice.

Professional liability insurers and solicitors specialising in professional negligence claims will often agree that engagement letters are one of the first lines of defence in a professional negligence claim against an accountant. When drafted properly, engagement letters form the basis for an enforceable contract and should have caveats unique to the scope of the service provided, the amount of risk inherent in the engagement, and the need to satisfy professional standards.

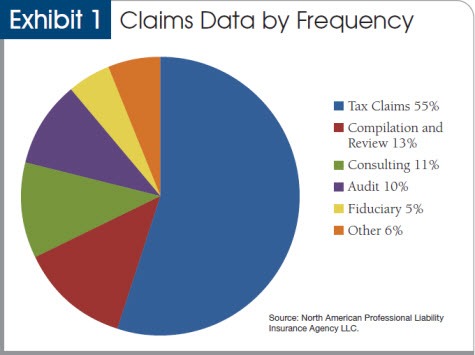

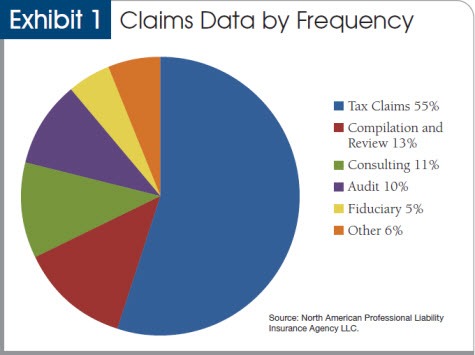

The majority of claims (by frequency) reported by leading professional indemnity insurers arise from tax services, yet, according to our experience, individual tax engagements are where engagement letters are least used. Recent data (January 2014) we have seen from claims arising in the USA show that well over half the claims (by number) arise from tax services.

While the advice that follows is focused on tax engagement letters, the same principles apply to most other types of engagement letter.

Here are some of the fundamental objectives in drafting good engagement letters:

1. Address the letter to the appropriate parties in a formal introductory paragraph. Exclude any taxes not within the scope of the tax return and exclude children of the client or other entities owned by the individual tax client and include the appropriate year or years that are being prepared.

2. Identify which returns are being prepared, and do not combine multiple returns. (For example, do not include a gift tax return service with an income tax return unless the proper disclaimer language for a gift tax return is included.) The following language is highly recommended.

‘We will prepare your [Year] income tax return. This engagement pertains only to the [Year] tax year, and our responsibilities do not include preparation of any other tax returns that may be due to any tax authority, If we receive specific instructions from you about other taxes or other tax years, these assignments will be the subject of separate engagement letters.’

Deal with the price of the service, payment terms, retainers, additional charges for information received late, additional fees. Clarity and diligence must be adhered to, as many professional liability lawsuits, professional body ethical complaints, and loss of clients have resulted from misunderstanding these provisions. Too often, a phrase like the following is used in a standard letter:

‘Our fee for services will be at our standard hourly rate for the personnel assigned to this engagement [or fixed fees to cover other than hourly fee arrangements]. Payment is expected when our services are complete.’’

Consider the following enhancements to the typical clause above:

o Specify more clearly the payment terms.

o If you wish, stipulate that a retainer will be required and will be applied toward the final fee and that the retainer is not an estimate of the fee charged for services.

o Identify when payment is expected.

o Provide for a termination of services if the fee is not paid in full.

o Use an additional charge clause for services not originally contemplated.

o Include a provision for reimbursement for out-of-pocket expenses such as travel, recorded delivery, etc.

3. Use a tax checklist that is sent to clients. The value of a tax checklist in defending a professional liability claim cannot be overstated. However, many tax advisers complain that their clients do not complete the checklist and often return it unopened. Accountants and tax advisers need to get the client to take responsibility for completing the checklist. The language used in the engagement letter should establish this responsibility:

‘We will prepare the returns from information which you will furnish to us. It is your responsibility to provide all the information required for the preparation of complete and accurate returns. We will furnish you with questionnaires and/or worksheets as needed to guide you in gathering the necessary information. Your use of such forms will assist us in keeping our fee to a minimum. To the extent we render any accounting and/or bookkeeping assistance, it will be limited to those tasks we deem necessary for preparation of the returns’.

Each firm has its own comfort level with respect to risk, and every client relationship varies. For this reason, many more areas should be explored for engagement letters than this article can address and this list is not necessarily exhaustive

Engagement Letter Checklist

The following checklist suggests additional considerations for engagement letters, return preparation, and administrative practices:

Exclusion clause. Because tax services can be broad, an exclusion clause that identifies what services will not be provided can be invaluable. For example, a payroll taxes preparation engagement might exclude subcontractor tax, personal or corporate tax compliance, and Forms P11D preparation.

Deadline for submitting return information. Establishing a date by which the client must provide the information needed to prepare the return is essential.

Limitation on use of the returns. Clients may submit tax returns and/or supporting data (like rental income computations) to third parties in lieu of a financial statement, for which potential liability can be addressed through a clause limiting the circulation of tax returns, supporting data and distribution and/or requiring advance written permission before allowing the client circulate the information to named third parties.

Tax position clauses. Many times, what the client thinks is acceptable will conflict with professional standards. Establish language stating that tax positions taken must satisfy professional standards.

Supporting documentation. Because a Revenue audit or investigation is always a possibility, remind clients of their responsibility to maintain adequate records to support the deductions claimed on the return. Include in the letter a reminder of the length of time for which the records should be maintained.

Revenue Audit or HMRC Investigation. Representing a client in a Revenue Audit may be more involved than the tax return preparation itself, for which many accountants may want to deal in a different manner to the main tax assignment e.g. by allowing for the use of specialist advice. The engagement letter should state that in the event of a Revenue Audit/HMRC Investigation the assignment will be covered by the terms of a separately signed engagement letter.

Outcome or results. The engagement letter is not a marketing device. Never guarantee the outcome or results.

Limitation of liability. Ensure such clauses are used appropriately.

Complaints/best service. Make it clear what the lines of communication are in the event of a dispute or claim (give the contact name for the Partner/Director in your organisation that will primarily handle client complaints) and in the event of failure to reach a satisfactory outcome, give the contact details of your professional body.

If interested in having a template engagement letter that follows the above advice, please see our list of engagement letters available for sale below.

Letters of engagement currently available as follows:

1. Limited company audit ROI

2. Limited company – audit exempt ROI

3. Sole trader NI/UK

4. Sole trader ROI

5. Limited by guarantee company ROI

6. MUD Act company – ROI

7. Northern Ireland/UK audit company

8. Northern Ireland/UK – audit exempt company

9. Taxation planning generally

10. Revenue audit Engagement Letter

11. Corporation Tax Engagement Letter

12. Income Tax Engagement Letter

13. Tax disengagement letter (used when a client has ceased using the firm’s tax services, but without a formal notification being received from the client). This letter sets the record straight, to avoid doubt.

These retail at €50 each +VAT, but we are prepared to do discounts for bulk purchases. Once ordered, you will receive a VAT invoice as well as the appropriate engagement letters by e-mail.

Please send us an e-mail to john@jmcc.ie with the words ‘engagement letter’ in the subject line.